Buying a second property is an intriguing notion that brings up a world of opportunities, from building a hideaway to earning money from rentals.

However, if you’re a first-time buyer of a second property, navigating the process can be difficult and intimidating.

How do you approach this crucial financial and lifestyle choice? We’ll go through the key factors and steps in the following article to help you start your exciting road toward getting your second home.

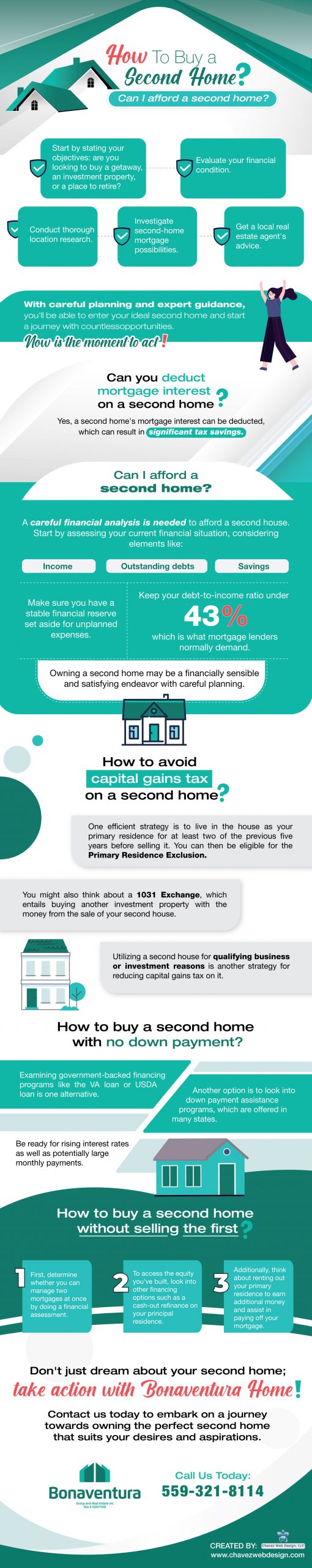

How to buy a second home

Purchasing a second home is an exciting endeavor that gives you the ability to escape, make money, or build memories.

● Start by stating your objectives: are you looking to buy a getaway, an investment property, or a place to retire?

● Evaluate your financial condition by taking into account all expenses, including the down payment and regular upkeep. Make sure to set aside money for unanticipated expenses.

● Conduct thorough location research, taking into account accessibility, amenities, and potential for appreciation.

● Investigate second-home mortgage possibilities while maintaining a reasonable spending plan.

● Get a local real estate agent’s advice, give property inspections top priority, and learn about neighborhood rules and taxes.

● Savor each moment that your second home gives when you enter it. To maintain its value and guarantee that it stays your retreat for many years to come, commit to routine upkeep.

With careful planning and expert guidance, you’ll be able to enter your ideal second home and start a journey with countless opportunities. Now is the moment to act!

Can you deduct mortgage interest on a second home?

Whether a second house is used for personal purposes, generates rental income, or both, this deduction can greatly lessen the financial burden of owning one.

You can keep more of your income after taxes by lowering your taxable income. It’s an effective strategy for turning your vacation property into both a fun investment and a source of delight.

Why should you wait?

Consider your options for having a second property to improve your lifestyle and financial security, as well as to benefit from this significant tax break.

A wise tax-saving move is to write off the mortgage interest on a second house. A few IRS requirements must be met to claim this deduction.

● For your second house to be eligible, it must be utilized largely for private activities, such as vacations.

● Second, rather than using the standard deduction, you must itemize your deductions on your tax return.

● Thirdly, if you’re a married couple filing jointly ($375,000 for single filers), you can deduct interest on mortgage debt totaling up to $750,000 between your primary and second houses. To maintain compliance with the most recent tax rules, keep thorough records of your mortgage interest payments and seek professional tax advice.

A second home’s mortgage interest can be deducted, which can result in significant tax savings.

Can I afford a second home?

A careful financial analysis is needed to afford a second house. Start by assessing your current financial situation, considering elements like income, outstanding debts, and savings.

Make a thorough budget that includes all expenses related to the second house, such as the down payment, mortgage, property taxes, insurance, upkeep, and unforeseen charges. Make sure you have a stable financial reserve set aside for unplanned expenses.

Keep your debt-to-income ratio under 43%, which is what mortgage lenders normally demand. Additionally, investigate second-home mortgage choices and make a fair assessment of your affordability. A financial advisor’s advice can be extremely helpful.

It’s also critical to consider how the purchase of a second property may affect your long-term financial objectives. If you want to maintain your financial stability, think about whether you can easily handle both your primary residence and the second home. Consider any potential tax repercussions, including deductions for property taxes. Investigate the neighborhood’s market circumstances and trends before making a purchase decision, as these factors may affect the property’s long-term value.

Even though owning a second property can be lucrative, it requires careful money management and knowledge of your financial capacity. You can make sure that your second house improves your life without becoming a financial burden by carefully analyzing the expenses and benefits.

Owning a second home may be a financially sensible and satisfying endeavor with careful planning.

How to avoid capital gains tax on a second home?

You can then be eligible for the Primary Residence Exclusion, which exempts from taxation capital gains up to $250,000 ($500,000 for married couples filing jointly).

You might also think about a 1031 Exchange, which entails buying another investment property with the money from the sale of your second house. This delays the need to pay capital gains tax until a subsequent sale.

To investigate these possibilities and guarantee compliance with tax laws, speak with a tax expert.

Utilizing a second house for qualifying business or investment reasons is another strategy for reducing capital gains tax on it. If your second home is rented out, you may be able to reduce your gains by deducting property-related costs including upkeep, management fees, and depreciation.

Consider the sales time as well. If at all feasible, hold off on selling for longer than a year because long-term capital gains are frequently taxed at a lower rate than short-term ones.

Finally, keeping informed of any modifications to tax regulations and seeking advice from a tax expert can give you useful methods to reduce your tax burden while protecting your investment in a second property.

How to buy a second home with no down payment?

Well, it is possible!

Buying a house on its own is an expensive process and the thought of having to pay a down payment can cause a headache for some people.

● Examining government-backed financing programs like the VA loan or USDA loan, which frequently don’t demand a down payment for qualifying veterans or homes in specified rural areas, is one alternative.

● Another option is to look into down payment assistance programs, which are offered in many states and offer grants or loans to pay the down payment. As an alternative, you can think about using the equity of your primary residence as collateral for a loan or line of credit, which would enable you to use the revenues as a down payment.

Although it may be intriguing to buy a second property with no down payment, it’s important to be careful and realistic. Zero-down payment solutions for traditional mortgages may be available from some lenders, but they normally call for good credit and a solid financial history.

Be ready for rising interest rates as well as potentially large monthly payments. As an alternative, think about forming alliances with family or friends to pool funds for a down payment, or investigate rent-to-own arrangements where a piece of your rent goes toward the eventual purchase.

Although buying with no down payment could appear appealing, keep in mind that it could result in higher overall costs and financial dangers. Do a thorough analysis of all your alternatives.

How to buy a second home without selling the first?

It takes planning to purchase a second property without first having to sell the first.

● First, determine whether you can manage two mortgages at once by doing a financial assessment. It will be essential to have a high credit score and a low debt-to-income ratio.

● To access the equity you’ve built, look into other financing options such as a cash-out refinance on your principal residence or a home equity line of credit (HELOC). This can give you the money for the second home’s down payment.

● Additionally, think about renting out your primary residence to earn additional money and assist in paying off your mortgage. The secret to effectively owning a second house without having to sell your first residence is careful planning and financial security.

Additionally, think about where and why you want your second house. You can lessen your financial load by choosing a more reasonably priced or lower-maintenance home for your second residence.

When you’re not using the second property, utilizing short-term rental platforms like Airbnb or VRBO can help you create extra revenue. This can save costs and increase the viability of having two residences.

Keep in mind that managing two residences necessitates careful planning and may incur additional expenses for maintenance or property management. In the end, you can realize the dream of owning a second house while retaining your first residing in your real estate portfolio with careful financial planning, rental revenue, and leverage of your primary residence’s equity.

Can a VA loan be used for a second home?

Maintaining your primary housing, having enough VA benefits remaining to support the second home, proving your capacity to pay both mortgages and planning to utilize the second home for personal rather than investment purposes are all requirements for eligibility.

Even if it is feasible, applying for a VA loan for a second property necessitates careful analysis and eligibility verification. You can navigate this option and determine its viability for your circumstances by speaking with a VA-approved lender.

In addition to competitive interest rates, VA loans also don’t require a down payment (up to a specified loan limit) and don’t require private mortgage insurance (PMI).

These advantages can make obtaining a VA loan for a second home an appealing choice, particularly for veterans and active-duty military personnel looking for a vacation house. However, you should think carefully before using a VA loan for a second property as it could affect your future eligibility for other VA loans.

Make sure to talk to a VA-approved lender about your circumstance so they can advise you on how to maximize your benefits while abiding by VA loan requirements.

Can a second home be considered a primary residence?

To do this, you must make it your primary address for things like voting, getting a driver’s license, and signing up for local services. By fulfilling these requirements, you may be eligible for several advantages, such as tax deductions and favorable mortgage conditions.

However, keep in mind that falsely claiming a second house as your primary residence may result in legal repercussions and financial penalties, so being truthful and abiding by local laws is essential.

Additionally, there may be financial costs associated with turning a secondary residence into a primary one. For instance, as primary residences frequently enjoy favorable tax status in comparison to second houses or investment properties, it might have an impact on your property tax rates.

Your eligibility for tax deductions, such as the mortgage interest deduction, may also be impacted. Furthermore, you might be required to pay capital gains taxes if the value of your second house increased significantly while you were residing there.

Before changing from a second house to a primary residence, speak with a tax expert and weigh the long-term financial repercussions to successfully negotiate these adjustments.

Unlock Your Second Home Dream with Bonaventura Home !